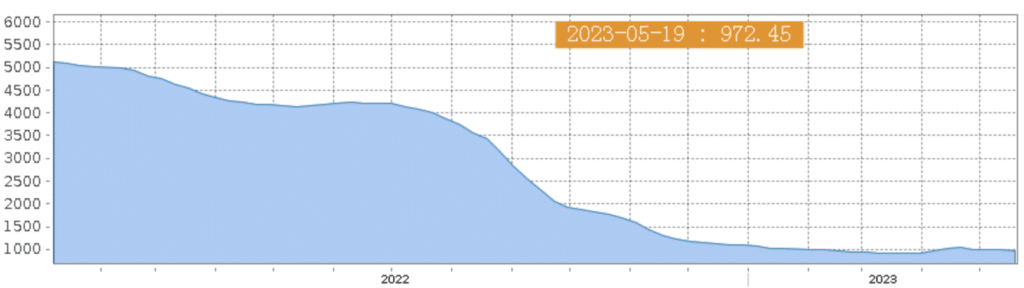

The freight rate fell four consecutive times! The US line is difficult to support the overall situation!

The Shanghai Export Containerized Freight Index (SCFI) has fallen for four consecutive weeks. The latest quotation on the 19th fell 10.96 points to 972.45 points, a drop of 1.11%. The demand on the US line is weak, new orders are limited, and the shipping company’s price increase plan in mid-May has died, and the freight rate is difficult to effectively support. This week, it has dropped by about $50 per FTU; the freight rate of the European and Mediterranean routes is relatively stable, and it is estimated that the shipping company will still continue to stabilize the freight rate by reducing the number of classes.

According to the latest SCFI index, in the US line market: the US West freight rate fell by $56 to $1,329/FTU, a weekly drop of 4.04%; the US East freight rate fell by $16 to $2,365/FTU, a weekly drop of 0.67%.

In response to the current situation, several freight forwarders pointed out that container shipping has returned to the buyer’s market, US retailers and importers are still destocking, and new orders are limited, resulting in the continued consolidation and bottoming of freight rates in the spot market. With the arrival of the traditional peak season, it is expected that there will be a wave of back-to-school, year-end holiday demand and replenishment from July, August to October. The volume of cargo will be the key factor for whether the freight rate of the US line will stabilize or even increase.

According to data released by the Federal Reserve Bank of New York, the New York Fed manufacturing index fell to -31.8 in May, and the order index also experienced the largest drop since April 2020. In addition, the spreading banking crisis in the US financial market and the debt ceiling negotiations also have a negative impact on the future recovery of the US economy. Market analysts pointed out that the current market competition is becoming more intense, and price wars among shipping companies are inevitable, but it also means more opportunities and market vitality.

For the European route, the latest SCFI index shows that it is relatively stable: the freight rate of the Shanghai-Europe route dropped slightly by $1 to $869/TEU; the freight rate of the Shanghai-Mediterranean route rose slightly by $4 to $1,616/TEU.

According to statistics, as of April 24, about 4.4% of the global container fleet (1.17 million TEU) was idle, a decrease from the recent peak of 6.4% (1.68 million TEU), mainly due to the return of 7500TEU-12500TEUS or above ships to the market. Oversupply, which drags down freight rates, is also the focus of observation. It is understood that many large ships returned to European routes. The impact on the market, including the launch of 2M’s nine ultra-large vessels to the Asia-North Europe and Asia-Mediterranean service networks next month, has yet to be assessed. However, the super-slow steaming approach for ships deployed on the 2M-operated ring is intended to absorb the gradual roll-out of capacity from newbuilds, mainly owned by MSC, thereby maintaining the status quo of weekly capacity provision. In the Australia-New Zealand route, the demand for various materials in the local market continued to stabilize and rebound, and the supply-demand relationship was good. The market freight rate continued to rebound this week.

The sea freight price war is about to be detonated

A few days ago, Hapag-Lloyd CEO Habben Jansen pointed out in the company’s financial report that the freight rate has been lower than the cost. Coupled with some recent market dynamics, it seems that container shipping is entering the abyss of price wars. The latest bi-weekly market report provided by Alphaliner shows that in the two weeks before the release of the report, the idle shipping capacity of global container ships has dropped sharply, and about 160,000 TEU of idle shipping capacity has returned to the market. The industry is worried that a price war will soon start. The statistics released by Alphaliner every two weeks show that the overall idle capacity is currently 1.17 million containers, and the ratio of the total capacity of idle ships to the total capacity of the existing fleet has dropped from 5.3% in the previous report to the latest 4.4%. The industry believes that the future volume has picked up in the near future, and now it depends on whether the volume of the recovery is equal to the proportion of idle capacity returning to the market.

In April, the total container volume imported by the United States reached 2.0202 million TEU, an increase of 9% month-on-month, and an increase of 5% compared with April 2019. Among them, the volume of imports from China increased by 27%, but it is the increase in April due to the unblocking of Covid-19 in China. Alan Murphy, CEO and analyst at Sea-Intelligence, a shipping consultancy, believes that there are three ways in which the container shipping market can avoid price wars: a surge in demand, large-scale demolition and idle capacity, and container shipping companies refusing to accept money-losing cargo. Although shipping companies do not seem to be well-managed in terms of shipping capacity, the current freight rate is still at the normal level before Covid-19. Based on this, the drop in freight rates is seen as a sign of market rebalancing rather than a price war.