The container ship deliveries on order will set a 20-year record next year

With record orders coming, the supply of container ship capacity tonnage may exceed ship demand next year, analysts warn: The global container shipping market may be heading for structural overcapacity!

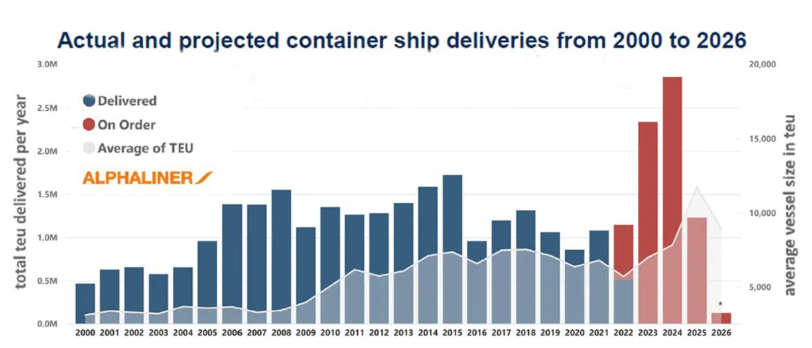

Container ship deliveries expected to be highest in 2023 and 2024

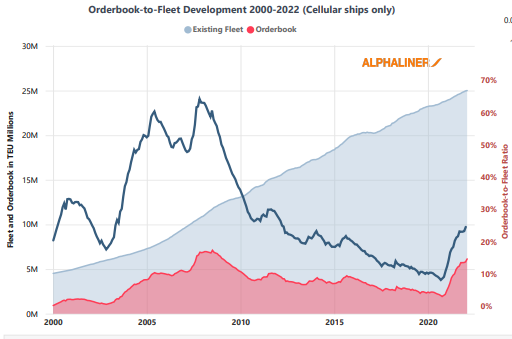

Alphaliner data shows that the order book for container ships of 7 million TEU has surpassed the record of 6.6 million TEU in 2008. In terms of capacity, 56% of the designated container orders are currently allocated to the world’s top five shipping companies. Although market demand continues to weaken, global container ship orders have continued to climb since mid-2022. While profits for container companies are still high, freight and container rates are currently in a clear downward trend, suggesting the market has peaked.

The new deliveries in the next two years will explode

In 2023, nearly 2.4 million TEUs of new container shipping capacity will be delivered worldwide, surpassing the previous peak of 1.7 million TEUs in 2014. More importantly, by 2024, an additional 2.8 million TEUs of new shipping capacity are expected to be launched. Clarksons’ historical delivery data shows that the global annual fleet has grown by an average of 970,000 TEUs over the past 20 years. Deliveries in 2023-2024 will be 2.6 times higher than the average. A large number of new ships on the market has obviously heightened concerns about overcapacity.

Market overcapacity

From a historical perspective, freight and container rates remain high. In the future, it is widely predicted that the market will normalize sometime in 2023. In many trade ways, freight volumes are weakening and freight rates are falling rapidly. The traditional peak season for the shipping industry has barely occurred in 2022, and many industry analysts believe the global economy is headed for a recession that is structural, not seasonal. War risks, high energy costs, political instability, and general inflation will affect overall consumer spending and trade. In addition, port congestion in recent months is easing. All of this means that next year, the supply will likely exceed the demand for ships again, and the shipping market may be heading for structural overcapacity.

The new environmental protection regulations

Some believe next year’s EEXI and CII regulations could be a turnaround for the shipment industry, with the biggest unknown factor being how the IMO’s carbon intensity index, which will come into force in early 2023, will affect dynamic vessel capacity. To reduce the carbon intensity of shipping, the new rules will result in some less efficient container ships making some concessions in speed. As a result, the market may require more ships to move containers at slower speeds. However, many modern large container ships will either not be subject to any prescribed speed penalty at all next year, or will limit their top speed to a level faster than the current normal sailing speed. At the same time, many older, more energy-intensive container ships are being deployed on regional routes that are not very fast and have long waiting times. The big size of container ship orders will minimize these effects, at least in the short term in 2023 and 2024.

Shipping companies are always ready

Today’s record 7 million TEU new-building program, a rapidly declining market, freight rates, and the risk of a global recession in 2023 have not stopped shipping companies from further adding to their already big-size container ship orders. Several industry giants are reported to be in “negotiations” with shipyards to procure several new series of large container ships. Whether the launching capacity of new ships in the next two years will become the last straw to crush the shipping logistics market, the industry will wait and see.

In short, the early warning issued when the shipping market is about to enter a crazy period: the container and the ship have to be built, and the timing is very important!