The birth of a new generation of shipping magnates

Aristotle Socrates Onassis, the name is the most well-known Greek shipping magnate in the West in the last century, was once the richest man in the world. Onassis was born into a tobacco merchant in 1906, but in 1922 his family became refugees. Then Onassis came to South America. He started growing tobacco after discovering that Greek tobacco was very popular in South America. His tobacco soon sold in Argentina and he made his first fortune. The Great Depression of the 1930s paralyzed world trade. At this time, Onassis purchased 6 container ships from a bankrupt Canadian company, laying the foundation for his future shipping empire. After the end of World War II, Onassis took out a large sum of money to invest in the construction of ocean-going tankers.

In the 1970s when Onassis was the richest man in the world, his shipping company was a magical existence, with a total of 400 ships of various sizes with a total of 3 million tons. Behind the magic history of the shipping, magnate is the 1970 shipping super-cycle that occurs once in 50 years. In his book, Dr. Martin Stopford, a well-known shipping economist, proposed several decisive factors that determine the super shipping cycle: demand, haul distance, geopolitics, ship age structure, and shipbuilding cycle.

In the 1960s and 1970s, when Onassis became the shipping magnate, firstly, the recovery of world demand after the end of World War II greatly increased the demand for fossil fuels. The closure of the Suez Canal in 1967 greatly increased the transportation distance. Finally, the oil crisis was caused by the geopolitical crisis in 1973.

A shipping super-cycle requires a simultaneous surge in prices and profit margins. In Martin Stopford’s theory, the conditions for this scenario are stable demand, increasing haulage distances, aging ship age structure, and disrupted shipbuilding cycles. Most importantly, geopolitical conflict arises, so the super-cycle begins.

The map drawn by Scorpio Tanker in this year’s report shows how far a geopolitical conflict can catalyze shipping distances. The full blue line in the figure is the European diesel import route before the Russian-Ukrainian conflict. From Russia’s ports in the Black Sea, it is transported to European ports via the Mediterranean Sea, with a distance of about 1,300 nautical miles. The blue dotted line in the picture is the refined oil transportation route after the Russia-Ukraine conflict. Under the new route, the oil tanker set sail from Busan, South Korea, sailed to the Strait of Malacca, crossed the Indian Ocean, and sent it to Greece via the Suez Canal. The entire route is 16,000 nautical miles, 12 times more than before. Instead of buying Russian oil, it seeks the supply of refined oil from outside the region, which truly makes this super long-distance route a reality. When the distance increased significantly, there were not enough tankers.

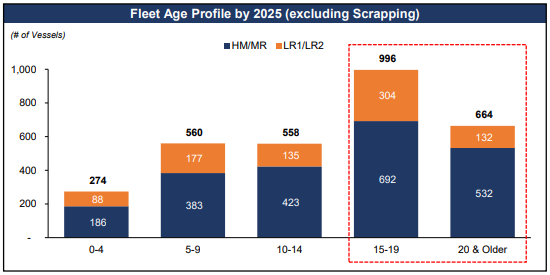

The century-old blockage of the Suez Canal in July 2021 has caused the supply of global container ships to be difficult for a long time, and many ports have become hard to find a container. After the blockage incident, major container shipping companies saw a lack of capacity and placed orders for new container ships. At present, major shipyards are full of unfinished ships, and orders have been placed after 2025. Moreover, in 2025, it is expected that 664 20-year-old oil tankers will be ready to retire, and 996 oil tankers that are no longer suitable for work due to aging and other problems.

The distance increases, the age of ships is aging, and new ships cannot be built, but the impact of Covid-19 is gradually weakening on a global scale, indicating that demand is about to recover. The demand remains unabated, the shipping distance is skyrocketing, the age structure of the ship is aging, the shipyard has no schedule, and the Russian-Ukrainian conflict is superimposed. All five factors are gathered in 2022.

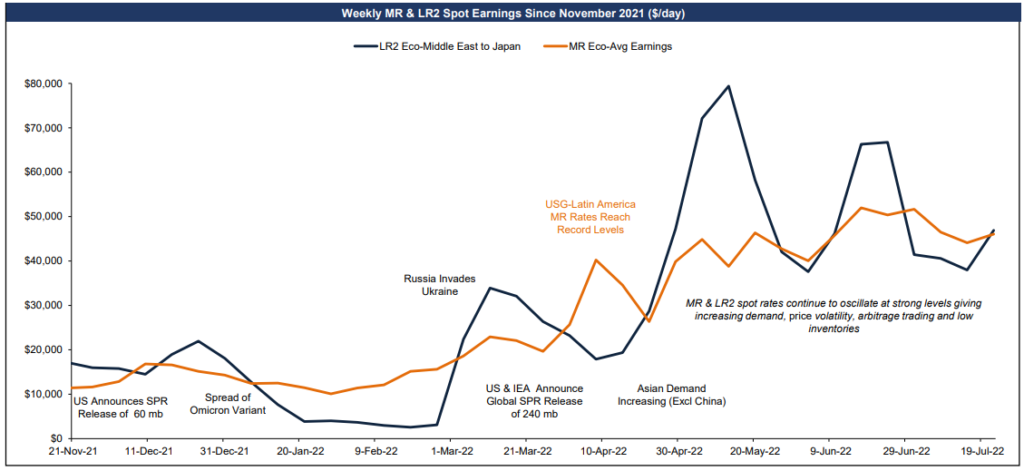

The quotation of sea freight TCE rate from the Middle East to Japan has increased from about $150 million/day at the beginning of the year to $70,000/day in May. The super-cycle means huge profits, and a new shipping magnate is about to be born.

At the beginning of a new super-cycle in 2022, shipping companies with relatively young fleets and refined oil transportation capabilities will soon continue to write the legend of the shipping magnate. We’ll wait and see who ends up winning. The new shipping magnate is coming.