On August 4th, Maersk released its financial report. Maersk reported strong second-quarter financial results, and the transaction volume and freight rate trends were in line with expectations. The rate of decline in revenue has slowed as rates and volumes continue to fall below their 2022 peaks. Inventories remain weak due to continued destocking, especially in North America and Europe.

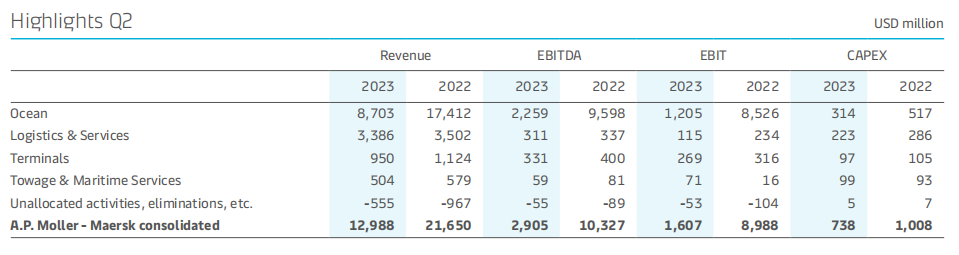

The report shows that despite the continued normalization of the market in the second quarter of 2023, which will lead to lower volumes and freight rates, the second quarter results are higher than expected. Although Maersk’s revenue in the second quarter of 2023 fell to $13 billion compared with $21.7 billion in the second quarter of 2022, the profit margin before interest and taxes still reached 12.4%. Based on the performance in the first half of the year, even if the market demand further weakens in the second half of the year, Maersk has raised its full-year financial forecast. EBITDA is now expected to be $9.5-11 billion and EBIT to be $3.5-5 billion.

Vincent Clerc, CEO of Maersk, said that due to the Covid-19 leading to destocking and weak growth, they responded quickly to the rapid changes in market conditions, and the second quarter performance contributed to the overall solid performance in the first half of the year. Decisive actions on cost containment and various contracts with customers have mitigated the impact of market normalization. Focused cost control will continue to play a central role in addressing the subdued market outlook and is expected to continue until the end of the year. In the second quarter of 2023, due to the decline in freight rates and volumes, the ocean freight business revenue fell from $17.4 billion to $8.7 billion year-on-year. Although the cargo volume and freight rate stabilized at a low level in this quarter, the demand for ocean freight business continued to decline due to the significant inventory adjustments in North America and Europe.

In terms of logistics and service business, revenue decreased from $3.5 billion to $3.4 billion year-on-year due to continuous destocking, weak consumer demand and low freight rates. As with the ocean freight business, market demand is expected to remain subdued as long as the destocking situation persists. Affected by lower demand, easing congestion at North American ports, and lower cargo volume and storage revenue, terminal business revenue fell from $1.1 billion to $950 million year-on-year, but strong cost control helped terminal financial performance remain solid.

The inventory adjustments observed since the fourth quarter of 2022 appear to be prolonged and are currently expected to continue through the end of the year. Based on continued destocking, A.P. Moller-Maersk now expects global container throughput growth in the range of -4% to -1%, compared to -2.5% to +0.5% previously. Ocean freight is expected to grow in tandem with the market.

For logistics and services, organic growth over the past 12 months was -3%, below the target of 10%. The trailing 12-month EBIT margin was 4.3%, compared with the target of 6%+. While performance is expected to improve sequentially, the 6% EBIT target for 2023 is not expected to be achieved given the current limited signs of a sharp rebound in sales in the second half of 2023.