Has fallen back to 2 years ago! The shipping fee to the west of the US breaks $2900?

Recently, the shipping fee from Yantian to Long Beach for a 40FCT container is $2,850. Last year, the price of some US-West routes exceeded $30,000. This year, the freight rate of US-West routes has dropped by 80-90% from the high point of last year.

Freight rates fell for 14 consecutive weeks and the decline expanded

The latest data of the world’s four major container freight indices still fell sharply.

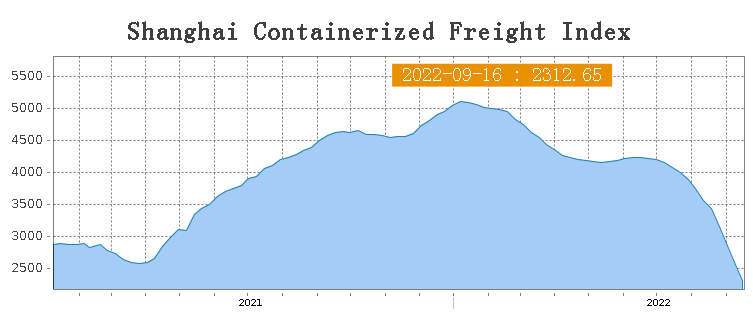

The Shanghai Container Freight Index (SCFI) was 2312.65 points, down 249.47 points from last week, with a weekly decline of 10.0%, which has been declining for 14 consecutive weeks. It was down over 40% from the same period last year.

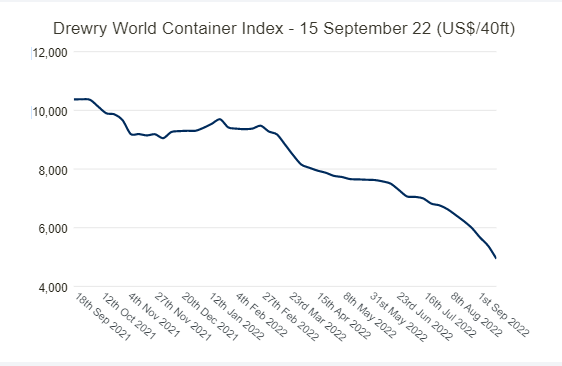

Drewry’s World Containerized Index (WCI) has fallen for 29 consecutive weeks, the latest down 8% to $4941.91 per 40ft container.

The Baltic Sea Freight Index (FBX) global composite index was $4,653/FEU, down 4% for the week;

The Ningbo Export Container Freight Index (NCFI) of the Ningbo Shipping Exchange closed at 1762.75 points, down 7.8% from last week.

The freight rates of the latest SCFI main routes continued to fall

North American routes: The performance of the transportation market failed to improve, and the fundamentals of supply and demand were relatively weak, resulting in the continued downward trend of market freight rates. The freight rate in the US West fell from $3,959 last week to $3484/FEU, a weekly drop of $475, or 12.0%, and the US West price recorded a new low in August 2020. The US East freight rate fell sharply from $8,318 to $7767/FEU, down $551 for the week, down 6.6%.

European routes: The transportation market continued to be weak, and the market freight rate continued to fall. The European base port freight rate is $3877/TEU, down $375 for the week, down 8.8%.

Mediterranean route: The freight rate was $4,222/TEU, down $552 for the week, down 11.6%.

Persian Gulf routes: The freight rate was $1,481/TEU, down $286 or 16.2% for the week.

Australia/New Zealand route: The freight rate was $2,489/TEU, down $173 or 6.5% for the week.

South American routes: fell for 7 consecutive weeks, the freight rate was $7183/TEU, a weekly drop of $798, a decrease of 10.0%.

It is worth mentioning that the Shanghai Container Freight Index shows that the freight rate has fallen for 17 consecutive weeks from the high point at the beginning of the year, then rebounded for 4 weeks, and then fell again for 14 consecutive weeks. In late July, it fell below the level of the same period last year. The market has been falling and falling.

What caused the plummeting ocean freight prices?

A professor at Fudan University Chun Ding said that the high inflation rate in Europe and the United States, energy crises, and Covid-19 have caused a sharp decline in shipping demand, which is the main reason for the plummeting global ocean freight rate. Chun Ding believes that although the current slump is to bring last year’s abnormally high freight rates back to a relatively normal level. It means that the high freight rates for ocean freight have come to an end. Others believe that the imbalance between supply and demand has led to the plummeting of ocean freight rates.

During Covid-19, due to the breakage of the supply chain, the supply of materials in some countries was cut off, and there was stockpiling in many countries, which also led to the occurrence of abnormally high shipping costs last year. This year, due to the high inflationary pressure in the global economy, demand has declined. At the same time, the previous inventory cannot be digested by the market, which has caused European and American importers to reduce or even cancel new orders, and the order shortage has spread around the world.

According to the data, in the third quarter of last year, about 30% of the global container ships were parked, and the proportion dropped to about 26% in the same period of this year, which shows that the global shipping turnover capacity has improved. On the other hand, the demand for shipping capacity in global trade has declined, so lower freight rates are inevitable.

Shipping companies face the pressure of contract price renegotiation

With the continuous decline of the freight rate in the market, Yang Ming Shipping company has publicly admitted that the shipping company is under pressure to “re-negotiate” the contract freight rate at the latest meeting recently, and said that it has received a request from the seller to reduce the contract price. It has also become the first shipping company to publicly admit to receiving bargaining requests. Yang Ming Shipping said: “In May, whether it is shipping to Europe or the United States, when negotiating the contract price, both sides are optimistic about the market, so the contract price is very high, but now the freight rate is sharply decreased. The drop put a lot of pressure on those contracts.”

For the global container shipping market, the third quarter is a traditional peak season. However, from July to September this year, the market failed to recover as scheduled but continued to fall under pressure. So, an earlier report released by Maersk also pointed out that the economic outlook of Western economies is weak, and consumer demand is still sluggish, resulting in a general performance during the peak freight period this year. Compared with the shipping price of tens of thousands of US dollars last year, the global container shipping market is still not optimistic in the fourth quarter, and there will be a sluggish market in the peak season.