Facing overcapacity and market downturn, why are shipping companies still placing orders for shipbuilding?

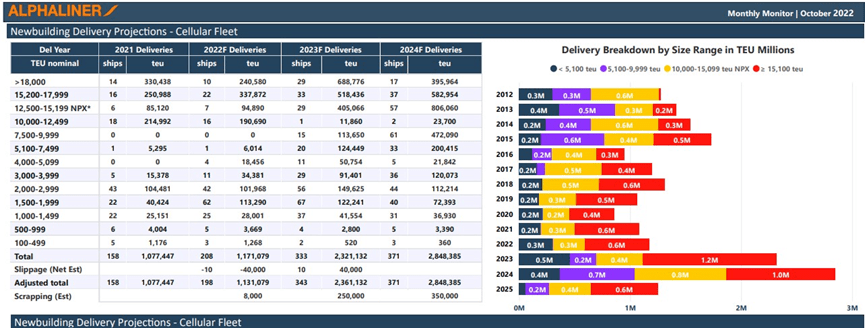

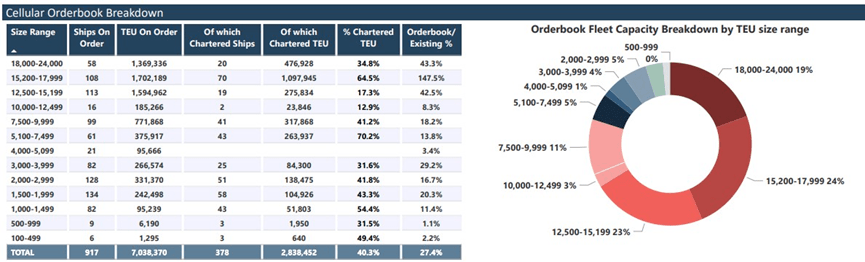

In the current market where freight rates are falling and fluctuations in supply and demand are obvious to all, many people feel that once freight rates fall, there may be structural overcapacity in the container shipping market, and shipping companies will definitely regret placing orders for too much capacity. Such logic can be very short-sighted. There are two explanations for this anomalous behavior. First of all, container shipping is a traditional strong cycle industry. The supply chain crisis in the past two years has shown that structural supply and demand imbalances, led to surges in freight rates and congestion. Freight rates are indeed too high, and it is normal to fall. Secondly, according to Alphaliner’s data, there are currently 917 global container ship orders with 7.04 million TEUs in hand, accounting for 27.4% of the total existing operating capacity. It is expected that 343 ships with a capacity of about 2.36 million TEUs will be delivered in 2023, and 371 ships with a capacity of about 2.9 million TEUs will be delivered in 2024. In terms of statistics, these are the highest values in history.

Carefully analyzing this wave of orders, we can find: Feature 1, the majority of new shipbuilding orders are large ships. Feature 2, although independent shipowners have also invested a lot of money in ordering container ships in the past two years, statistics show that the orders of the top 11 shipping companies in the world account for 83.2%, and more than 94.7% of new ship orders have contracts support. Feature 3: The newly ordered ultra-large ships over 10,000 TEUs are basically ships that use green fuels such as methanol and LNG.

1. Conventional capacity allocation is a good time for shipbuilding

Judging from features 1 and 2, this wave of new orders for container ships is more like a targeted capacity structure optimization by major shipping companies, and it also meets the traditional logic of long-term investment in container ships. From the perspective of shipping companies, like other traditional cyclical industries, the operating management level of companies with cost management as the core is still the key for shipping companies to maintain their competitive advantages. As the most basic production tool in the shipping industry, ships are the basis for forming production and operation capabilities. Therefore, even if the freight rate falls, the shipping company still needs to build ships according to the needs of capacity renewal.

In fact, in recent years, leading shipping companies represented by Maersk are paying more and more attention to continuous investment to improve the reliability of the supply chain. In the future, the spot freight rate may be further reduced, the leading shipping company has more and more ships, and the density of route coverage and service reliability are getting higher and higher. This should be a good thing for cargo owners and the global value chain.

2. Pioneers in decarbonization

Judging from the third feature, shipping emission reduction is imperative. Despite the uncertainty of fuel and decarbonization paths, leaders in the container shipping industry have become pioneers. Ordering large ships that use green fuels such as methanol and LNG is not only meeting the requirements of environmental protection but also more like the preparation for the main shipping companies to lead the future development trend.

a. MSC ordered 42 LNG dual-fuel powered container ships

In the case of accelerating normalization of spot freight rates in the container shipping market, MSC recently ordered another 12 16,000 TEUs LNG dual-fuel powered container ships. The order, believed to be MSC’s fifth in 2022, is worth $2.16 billion and is expected to be delivered between late 2024 and 2026. Counting these 12 new ship orders, MSC ordered a total of 42 LNG dual-fuel powered container ships last year, worth more than $6 billion dollars.

b. Maersk methanol container ship orders have reached 19

Recently, Maersk announced the signing of an agreement with South Korea’s company to order another six large-scale green methanol-fueled container ships. Each of these ships has a capacity of about 17,000 TEUs and will be delivered in 2025. With this order, Maersk is currently on order for 19 methanol container ships. The new ships are all part of Maersk’s ship replacement plan, and their capacity will replace the capacity of ships that have reached the end of their life cycle by an equal amount. Maersk Group’s ESG shows that Maersk has set an overall goal for all operations to achieve net zero emissions by 2040, but by 2030, a quarter of Maersk’s ocean freight volume must be transported on ships using green fuels, carbon emissions reduced by 50% compared to 2020.

In conclusion, whether it is from the perspective of shipping companies or from the perspective of the global value chain, this wave of new orders for container ships has its rationality. In the past two years, main shipping companies have gained huge profits in the super cycle. They have also spent a lot of profits on investing in new ships, ports, land, and energy transformation, and continue to invest in improving the supply chain.