Currency depreciation storm in many Asian countries

A few days ago, the exchange rates of various countries fluctuated frequently. In Asian currency markets, other currencies were also volatile.

RMB exchange rate is basically stable

In the first four months of this year, the exchange rate market was generally stable. The RMB exchange rate is also basically stable. However, since mid-May, as the U.S. dollar index has fluctuated and strengthened, and China’s economic recovery has fallen short of market expectations, pressure on the RMB to depreciate has increased, and the offshore RMB/USD exchange rate once fell below 7.28. Recently, the exchange rate of onshore and offshore RMB against the U.S. dollar has changed from falling to fluctuating and rising, and both regained the 7.22 on July 4. Cross-border capital flows remained basically balanced under exchange rate fluctuations. Although the RMB exchange rate fluctuates in the short term, it is supported by solid fundamentals. The market awareness and expectations for two-way exchange rate fluctuations have gradually formed.

The central parity rate of the RMB against the U.S. dollar has also been raised continuously in the past three days. On July 5, the central parity rate of the RMB was raised by 78 basis points to 7.1968. As of noon on the 6th, the exchange rate of the offshore RMB against the U.S. dollar was at 7.2585, an appreciation of 10 basis points from the closing price of 7.2595 on the previous trading day, with the highest reported at 7.2678. As of noon on the 6th, the exchange rate of the onshore RMB against the US dollar was 7.2484, a depreciation of 111 basis points from the closing price of 7.2373 in the previous trading day, and the highest was 7.2511.

Asian currencies tumble

At the same time last year, the Asian currency defense war has already been staged once. Many countries in Asia have experienced it. And a year later, a similar scene seems to be kicking off again. However, there is one most important difference between the Asian currency defense battle this time and the same period last year, that is, the strong US dollar that was once invincible at that time did not reappear this time. In other words, this time it is largely the regional currencies of Asia that are at risk of exchange rate depreciation.

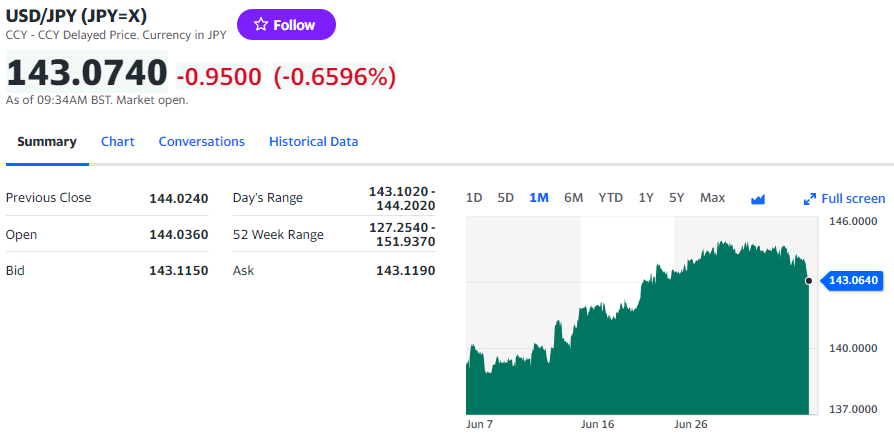

Recently, the yen fell. The latest trading of USD/JPY was at 143.07, which hit the highest level since November last year at 143.87 on June 23. So far, the monetary policy stance of the Bank of Japan is very different from that of the European and American central banks. The loose stance of the central bank is the main reason for the depreciation of the yen. The current volatility of the yen against the dollar is one-way and rapid.

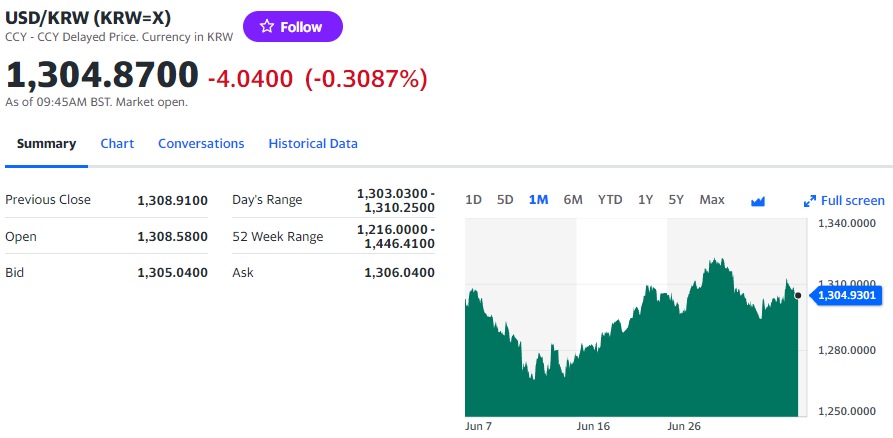

In addition, while the yen and RMB have fallen recently, the Korean won has also begun to lose more in the past two weeks. On June 21, the South Korean won fell 1% against the US dollar within the day, the biggest drop in two months. The exchange rate at noon on the 7th is shown in the figure below.

Outside of East Asia, the Turkish lira is also trending lower. The exchange rate at noon on the 7th is shown in the figure below.

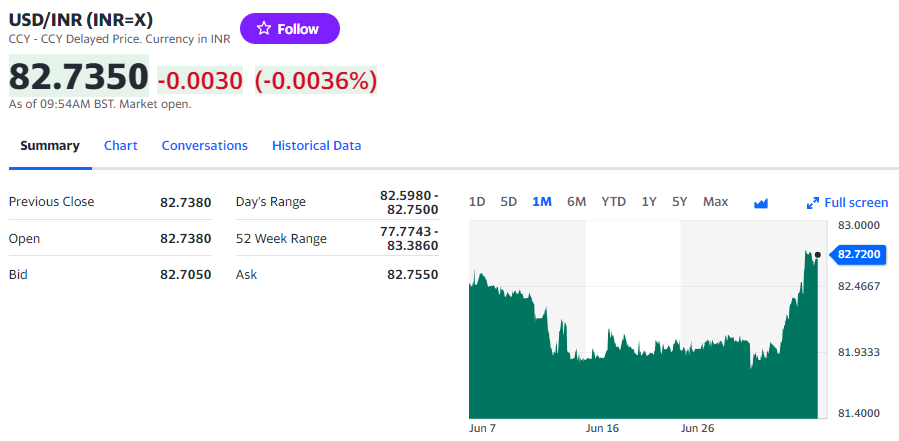

Apart from this, the Indian rupee is also falling. The exchange rate at noon on the 7th is shown in the figure below.

Asian currencies such as the Thai baht and the Singapore dollar, and commodity currencies closely related to the Asian economy, such as the Australian dollar and the New Zealand dollar, have gradually begun to show some weakness.

On the whole, there are two factors that have a relatively huge impact on Asian currencies at the moment. The first is the current export dilemma facing Asia. The slump in global trade has largely hit Asia’s merchandise imports and exports over the past few months due to changing global economic conditions. At the same time, another key reason for exacerbating the depreciation of Asian currencies is the interest rate hike cycle of major western economies in the past few weeks. This has made the direction of Asia’s economic development increasingly uncertain. At present, major western economies are raising interest rates one after another, while various countries in Asia are clearly showing a more loose monetary policy. Except for the RMB, East Asian currencies have been extremely weak recently, which is a very unique phenomenon in the current global foreign exchange market. Therefore, sellers in various countries should always pay attention to changes in exchange rates. This year’s international economic situation may fluctuate greatly.