Global Air Cargo Prices Stabilize

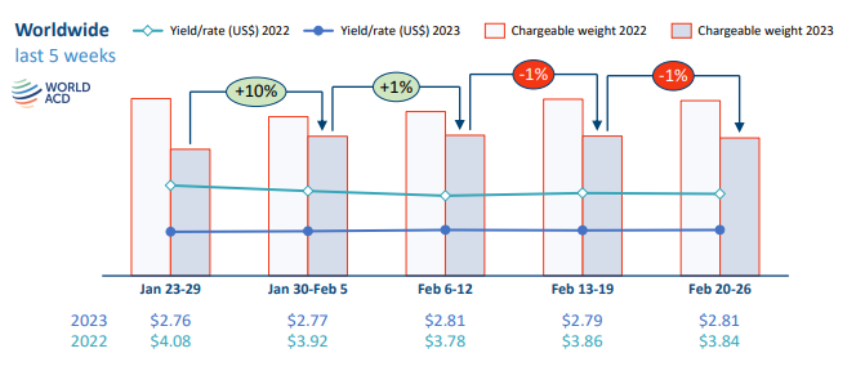

The latest data from World ACD Market Data, a Netherlands-based global air cargo market research company, shows that global air cargo prices are currently stabilizing. Figures for week 8 (20-26 February) showed a slight decrease (2%) in global tonnage compared to the previous week, according to World ACD, which collects more than 400,000 transactions per week. Comparing weeks 7 and 8 with the previous two weeks (2Wo2W), weeks 4 and 5 saw a 1% decrease in gross tonnage, accompanied by a 2% increase in capacity, and global average freight rates remained stable.

On a regional level, on a 2Wo2W basis, the post-Chinese New Year recovery in air cargo tonnage continues to be significant outside of Asia Pacific to Europe (+16%), Middle East and South Asia (+22%), North America (+10%) and more. The most notable decline was from Central and South America to North America (-20%) and from Africa to Europe (-14%), largely driven by a surge in flower exports in the run-up to Valentine’s Day. For the global market as a whole, week 7 and week 8 billable weights were down 21% compared to the same period last year. Most notably, tonnage outside Asia-Pacific fell by 39%.

This comparison is biased though, as Chinese New Year started on February 1 last year, 10 days later than January 22 this year. Year-over-year double-digit percentage declines were in North America (20%), the Middle East and South Asia (13%), and Europe (11%). African outbound tonnage increased (7%) compared to the previous year. Despite the impact of higher fuel surcharges, global freight rates are now 27% lower than a year earlier and currently average $2.81 per kilogram, but are still well above pre-Covid levels.

With 110 freighters and 18 passenger planes currently in service, ATSG has fared better than all-cargo carrier Atlas Air, which recently reported a 24% decline in fourth-quarter adjusted earnings. But Atlas Air leases far fewer aircraft than ATSG, making it more vulnerable to volatility in the air cargo market that has been depressed since last March. ATSG said earlier this month that Amazon and DHL Express were reducing flights on planes operated by Air Transport International (ATI) and ABX Air, signaling weaker consumer demand and slower growth.

While aircraft utilization and revenue from its long-term charter business have declined in the short term, global e-commerce sales topped $5 trillion for the first time last year and are expected to reach $7.4 trillion by 2025, according to eMarketer. E-commerce is expected to account for nearly 24 percent of total retail sales by 2025, up from 17.9 percent in the 20th century. Specialist Cirium predicts that 3,560 freighters will be supplied over the next 20 years, including 1,060 newbuild freighters worth $130 billion (30%) and 2,480 converted passenger aircraft (70%). This is the main reason why ATSG still believes leasing activity of its converted freighters will continue to increase.