From December 15th, the freight rate of this route will be raised!

As ocean freight rates continue to drop, the industry is generally concerned that the market is facing a hard landing, and shipping companies are also actively taking various measures to slow down the decline in freight rates. As the shipping companies stepped up their efforts to control the shipping capacity, the decline in freight rates moderated. Recently, some shipping companies have started to increase the freight rate of Southeast Asian routes.

OOCL raises freight rates in Southeast Asia

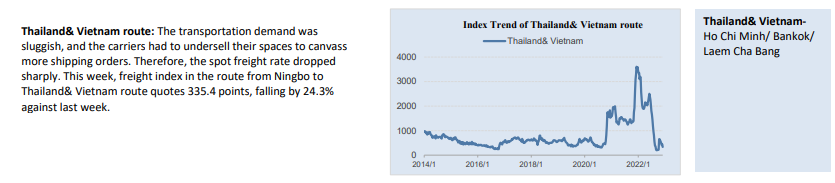

The freight index of the Thailand-Vietnam route from November 26 to December 2 was 335.4 points, down 24.3% from last week. The report pointed out that the demand for transportation on the Thailand-Vietnam route was weak, shipping companies used low prices as the main ways to strengthen their sales, and the spot booking price fell sharply. However, OOCL did the opposite. Recently, the shipping company issued a notice that starting from December 15th, the freight rate for products exported to Southeast Asia will increase on the original basis, $100 for a 20GP container, and $200 for a 40GP container.

The Southeast Asian routes have considerable changes. Judging from the quotations in the spot market, during the one-month period from the end of October to the beginning of December last year, the shipping fee for a 40GP container on the route from South China to Ho Chi Minh Port rose from the original $500 to $2,000-$2,500. However, during the peak season of shipping in September this year, the Thai-Vietnamese route was sluggish, and there was even a situation with a $0 freight rate.

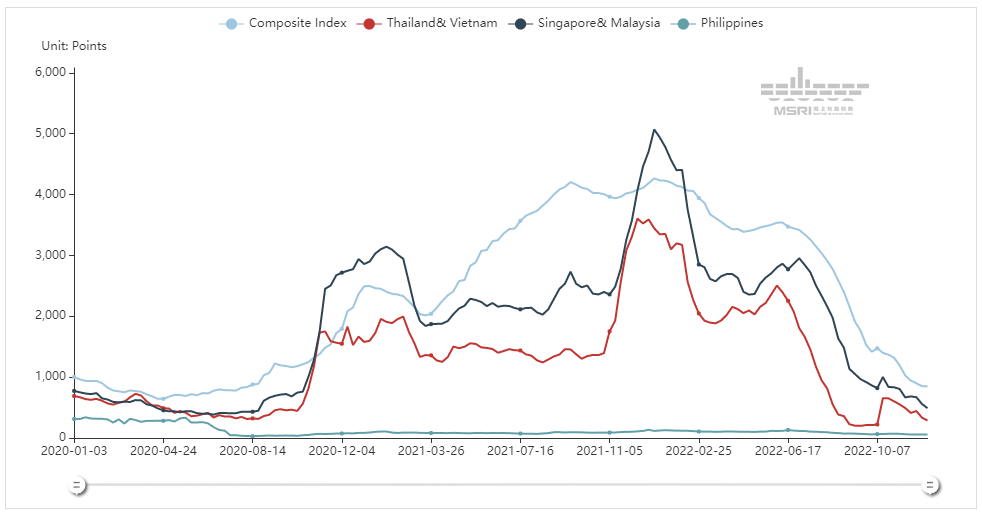

The Maritime Silk Road Index released by the Ningbo Shipping Exchange shows that since 2020, the freight rates of the routes to Thailand and Vietnam, as well as the Southeast Asian routes to the Philippines and Singapore, and Malaysia have been rising all the way, but since the second half of this year, the Southeast Asian routes have continued to decline and rose slightly in October. Not only Southeast Asian routes, but the whole shipping market is in a state of continuous decline. According to the World Container Freight Index released by Drewry last week, the spot freight rate on the Asia-Europe route fell by 10% within a week to $1,965/FEU, a figure that has fallen by 50% in the past four weeks. The industry predicts that if the freight rate of the Asia-Europe route continues to decline, the spot freight rate will fall below $1,500/FEU around Christmas.

100 sailings canceled over the next five weeks

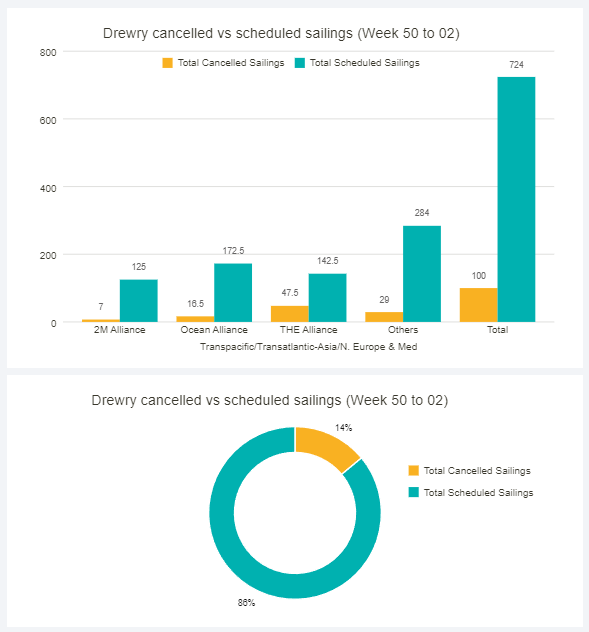

Out of a total of 724 scheduled sailings on the main trade lanes across the Pacific, Transatlantic and Asia-North Europe, and the Mediterranean, in weeks 50 (December 12-18) and week 2(January 9-15), according to the latest data released by Drewry, 100 sailings were announced to be canceled, accounting for a cancellation rate of 14%. During this period, 55% of blank sailings will occur in the Transpacific Eastbound, 25% in Asia-North Europe and the Mediterranean, and 20% in the Transatlantic Westbound trade.

In the next five weeks, the three major alliances canceled a total of 71 sailings, of which THE Alliance canceled 47.5 sailings at most, and the Ocean Alliance and 2M Alliance canceled 16.5 sailings and 7 sailings respectively. Drewry said the shipping industry continued to readjust before the Covid-19 levels. Next year the market is likely to still face major challenges of excess capacity and declining volumes. From the fourth quarter to the next two years, a large number of new container ships will be delivered. In January 2023, the effective capacity of the main east-west trade will increase by 12% year-on-year. As the challenge of oversupply intensifies, the shipping companies are bound to continue to increase the number of combined shifts and cut routes, not only to stabilize the spot price but also related to the signing of long-term contracts for European and American routes.